Potential Tax Risk to Realtors: Non-Resident Vendors of Canada for Tax Purposes

The Supreme Court ruling of Mao v Liu (2017 BCSC 226) has potentially opened lawyers, notaries and real estate agents to liability under the Income Tax Act when dealing with vendors who are non-residents for tax purposes. Pursuant to the Income Tax Act a Canadian resident seller of residential property is normally exempt from capital gains on a principal residence. However, non-resident sellers pay a capital gains tax of 25% on the profit of the sale of the residential property from sale proceeds.

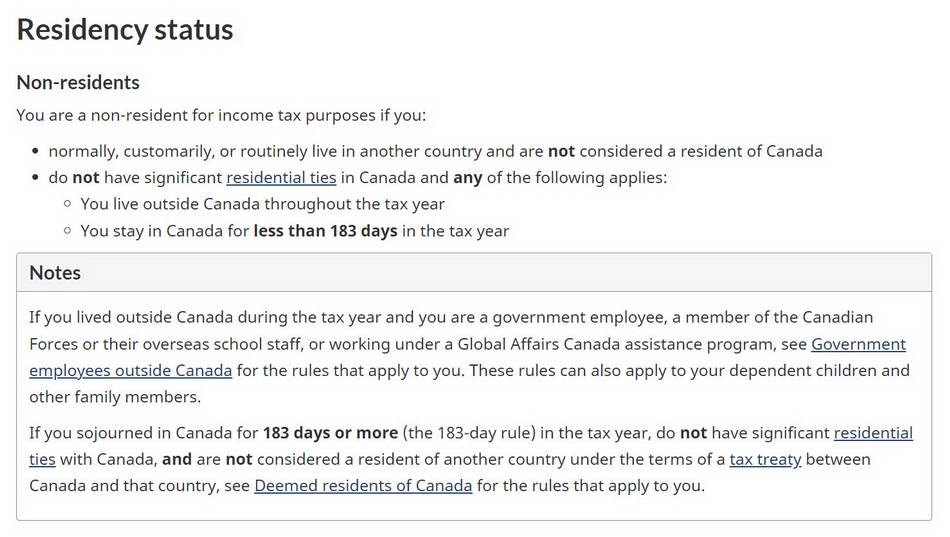

The following, in really simplifying this area of the law, describes who would be considered a Non-Resident under the Income Tax Act:

Section 116 of the Income Tax Act requires a buyer to “make reasonable inquiries” to ascertain the residency status of any seller of real property and normally the buyer will rely on their notary/lawyer and real-estate agent to fulfill this responsibility.

If the buyer does not make reasonable inquiries, as assessed by Canada Revenue Agency (“CRA”), the seller is non-resident and does not pay the applicable capital gains tax, the buyer will be assessed the entire tax and required to remit the tax to the CRA.

Mao v Liu (2017 BCSC 226)

Mao v Liu (2017 BCSC 226) involved a notary public who was required to pay the Canada Revenue Agency $695,000 because he did not adequately determine if the house his client was buying was owned by a tax resident of Canada.

Normally, to protect the buyer if the seller is a non-resident, the notary/lawyer representing the buyer will holdback 25% of the purchase price to cover any potential tax liability should the seller not pay the applicable capital gains tax. The buyer in this case was assessed the capital gains tax by CRA and in turn sued the notary for this tax liability and succeeded. The notary was found to have negligently completed the conveyance without confirming the residency status of the seller, not holding back 25% of the purchase price and not advising the purchaser of their potential tax liability.

Potential Risk to Realtors

Realtors can open themselves up to a claim from a buyer assessed with the tax liability should it be found the agent did not do their part to make reasonable inquiries as to the residency status of the seller. Generally, a reasonable inquiry starts with the seller initialing the clause regarding the residency status on a Standard BC Real-Estate Contract (depending on which version you are using). Therefore, it is wise to ensure reasonable efforts are made to determine the tax residency status of the seller to protect the buyer as a notary/lawyer could seek recompensation from realtors to attempt to decrease their liability.

Therefore, a buyer’s realtor can protect themselves by:

• Generally taking extra precaution when purchasing from a non-resident

• Ascertaining legal residence status prior to closing

• Insisting the residency/non-residency section of the contract of purchase and sale is completed.

• Structuring contracts to include a holdback of 25% until the residency of the seller is verified. The holdback can be released upon verification of the seller being a Canadian resident. Should the seller be a non-resident or believed to be a non-resident then the holdback would remain with the buyer’s notary/seller until a compliance certificate is issued from the CRA. The compliance certificate would be adequate proof to the buyer that taxes have been paid, no taxes are owning or adequate security has been provided by the seller. Note, the Income Tax Act allows the buyer’s notary/lawyer to holdback 25% of the sale proceeds if the seller’s residency is unknown or is thought to be a non-resident. A Clause stipulating this is not required in a contract but it would be prudent to include it so all parties are aware.

• Documenting all conversations with the notary/lawyer and buyer regarding the potential tax liability should the seller be a non-resident.

• Removing themselves after they have done their due diligence to ascertain the residency of the seller and not get involved in any communication between the notary/lawyer and the buyer. Do not be the conduit for information to pass through on this topic and let the notary/lawyer speak directly to the buyer.

Foreclosure sale or Court Order Enforcement Sale

A foreclosure sale or court order enforcement sale complicate the issue as the registered owner is not the seller of the property according to BC case law. The bank or the judgement holder replaces the registered owner and signs the contract instead of the registered owner. However, CRA does not follow the same approach and considers the registered owner to be the seller of the property. Hence, the foreclosing party normally are not prepared to make any representations regarding the property or the registered owners and therefore will not confirm the residence status of the registered owner. This scenario arose is in the Mao v Liu (2017 BCSC 226), however, that sale was regarding a court order enforcement proceeding. Therefore, when the sale is due to a foreclosure or court order enforcement proceeding extra caution should be taken and seek legal advice before drafting the offer to purchase. You do not want to end up in a similar situation as the notary in Mao v Liu.